This is not a post I was proud to write, publish, and share with the world forever. But it’s something I wanted to document for myself and for the future.

Twenty years ago today was the first of several times in my younger adult years that I truly experienced what it was like to be broke. While this is not an anniversary I look fondly upon, it did help me begin to learn lessons about financial responsibility that have proven invaluable.

Many will read this story and roll their eyes because it is, admittedly, a #whitewhine or #firstworldproblem. But it was an eye-opening experience for a college freshman who grew up in a firmly middle-class family and whose parents sacrificed a lot to provide their three sons with the expensive shoes, toys, and experiences that kids gravitate toward.

What could have caused this feeling? I was attending a swanky, private college two states away from home, had a dormitory roof over my head, and a meal plan with so much credit available that most days I struggled to spend my allotment.

Brace yourselves for the horror: I did not have the cash in hand (nor the credit, but we’ll get to that) to purchase Cypress Hill’s “Temples of Boom” album during its release week.

I had a plan and was ready to take on the world

I had arrived at college with what I believed to be enough spending money to get me through the first year. My parents wisely advised me to keep half of it in an account back home, to be transferred to my college account for the second semester.

That turned out to be a lifesaver, as I likely would have blown through the entire amount within the first month on my own. Imagine my surprise when purchasing my first-semester books and class materials and the total represented about 35% of what was in my account. I still remember my Mom looking at me and saying, “Everything in life costs more than you think it will. Get used to it.”

A part-time, on-campus work-study opportunity was made available, but rather than serve french fries to my peers I decided to get a job at the Pizza Hut up the street. This turned out to be a wise move from a professional standpoint, as corporate management had cleaned house after an inside-job theft case that summer. Plenty of hours were available to a baby-faced college kid in need of walking-around money.

It was not the wisest move for my academic career, as I found myself working 5-6 afternoons and evenings a week, racking up 35, 40 hours a week and sometimes more. I entered college with no idea how much outside-the-classroom time it takes to succeed academically, and spending that time working for near-minimum wage was not a great use of my tuition money. But I was surrounded by rich kids with no need to work, and I wanted to keep up with the Joneses and have the same “college” experiences as everyone else.

Trying to find a balance

As September bled into October, I was earning a decent paycheck every other week, but college life was proving to be expensive. The savings I arrived with was essentially gone, and every day seemingly brought the opportunity to attend an event, catch a ride to the mall, venture out for a late-night snack and so forth. But I kept going along with it because, hey, everyone else was doing it.

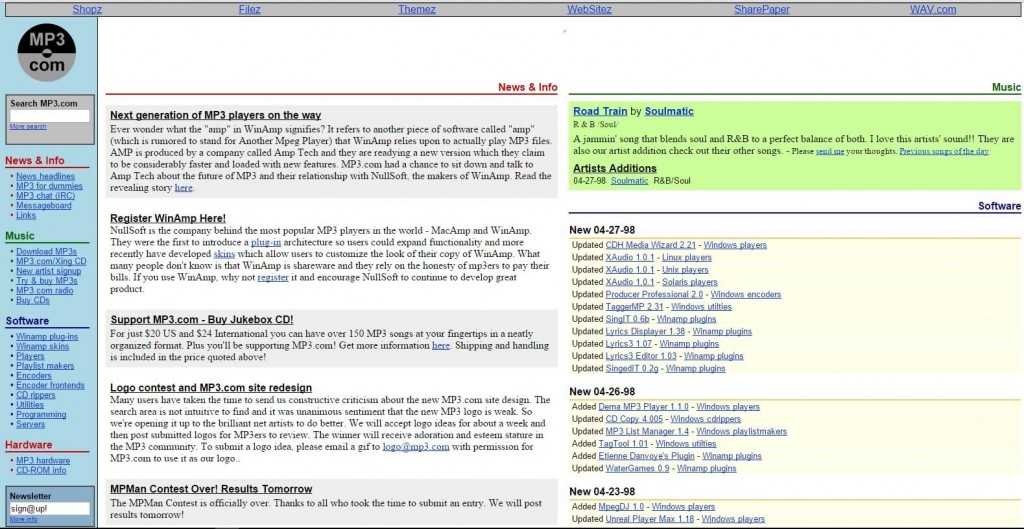

Back then, before I was old enough to purchase alcohol or frequent bars and clubs, my vice was (and is to this day) music. This was 1995: The Internet was in its relative infancy, widespread broadband connections and ubiquitous WiFi was non-existent, there was not a smartphone in every pocket, and streaming services containing the history of recorded music were a pipe dream. Hell, this was before most people knew what an mp3 was, much less where to find and how to use them.

(Yes, kids, these were truly the olden days. You either listened to whatever was on FM radio or physically visited a record store to make a purchase. If you were lucky, a friend would do the same and exchange dubbed cassettes, in effect doubling your buying power.)

There were record stores in most malls, and this was at the height of Best Buy’s strategy of using music as “loss leaders” in order to entice consumers with low CD prices and hope they also made big-ticket purchases. But I always liked to frequent the independent music sellers, given the greater chance that I would find something new, rare, or unexpected.

There was a record store about a mile from campus, and in those early weeks I would walk there every Tuesday after my final class. (Also a nod to the olden days, new music was released on Tuesdays.) An average purchase was $30-40, as CDs were $13-14 and I could always find a couple good ones. I mean, I had a (text-only) Internet-connected PC in my dorm room, so discovering new bands during late-night, web-surfing was my new favorite pastime.

The house of cards topples

And then things caught up to me. As any Intro to Macroeconomics (a required class that I put off until my junior year) student can tell you, a deficit is the result when expenses exceed revenue. And that’s exactly where I found myself exactly 20 years ago this week: My checking account showed a zero balance.

Luckily for me, this scenario played out prior to beginning my illustrious dalliance with credit cards. Good thing, too, as had I not experienced a complete lack of money at least briefly, I probably would have been even more carefree in my use of plastic.

I awoke on Monday, Oct. 30, 1995 knowing that I was in uncharted financial waters. I was paid biweekly, and the past Friday had not been payday. That weekend I somehow was not scheduled to work and had gone out and partied it up for Halloween. My meal plan did not include Sunday dinner, and by the time I dragged myself out of bed the campus food service was closed. I spent my last $10 getting something from an off-campus restaurant.

I had laundry to do, supplies to purchase for a class, and probably other expenses that were mounting quickly. Things had been tight for the previous few weeks, but I was always somehow able to stretch things out between paydays and still enjoy my weekly trips to the record store.

When I realized my financial situation, it dawned on my that the long-awaited Halloween release of “Temples of Boom” would not include me. I have long been a Cypress Hill fan, their music somehow finding its way to me in early 1990s, small-town Wisconsin well before they hit the mainstream.

I have always taken pride in identifying up-and-coming bands and musicians, and while my musical tastes had begun to drift away from hardcore rap and hip-hop when I entered college, I still had a place in my heart for the Hill. Not having enough cash in my pocket and checking account — combined — to purchase that album was quite the moment for young Eric.

The aftermath and lessons learned

I got paid that Friday, but because I was behind and there were many other financial obligations, I did not purchase that album. In fact, the trips to the record store became far less frequent. This may have been in part because the onset of November and December weather made the 2-mile round-trip walk less appealing, but also because I had learned a valuable lesson: Getting in over your head with money matters was not a feeling to which I wanted to become accustomed.

Please know that this was not the most-dire financial situation I have ever faced. While I still have never experienced true, prolonged poverty or — thanks in large part to working in restaurants for the better part of my late teens and early 20s — extended hunger, there were definitely some lean weeks, months, and even full years in which I was technically considered “poor.” Although due to the aforementioned credit-card use, I never considered myself in that light. But that’s another story about another lesson learned for another day.

I never bought a copy of “Temples of Boom.” Whether this was intentional or accidental I do not know. But it definitely is symbolic. When I saw this morning on Facebook that it was the 20th anniversary of the album’s release date, it immediately took me back to those feelings I had as a scared 18-year-old, facing the world for the first time.

But I then realized how hard I have worked and how far I have come, grabbed my smartphone, fired up Spotify Premium, pulled up “Temples of Boom,” casted it to the TV via my Chromecast and enjoyed.